GETTING TO KNOW REITS

1) What is a REIT?

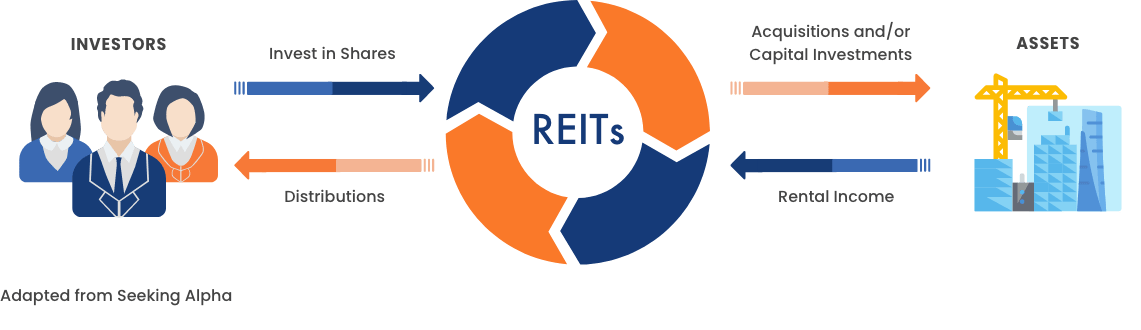

A real estate investment trust (REIT) is a stock corporation established principally for the purpose of owning income-generating real estate assets such as apartment buildings, office buildings, hotels, resorts, warehouses, shopping centers, among others. It is a type of investment instrument that provides a return to investors derived from rental income of the underlying real estate asset.

2) What are the benefits of investing in a REIT?

The purchase of shares of stock of REITs allows investors, especially small or retail investors, to participate in the ownership of one or more income-generating real estate.

As an investment, REITs attract many investors due to the following benefits they offer:

Dividends

As mandated by law, investors can expect to receive annually 90% of distributable income as dividends.

Liquidity

Investors can easily purchase and dispose of REIT shares, which are readily convertible to cash.

Diversification

REITs allow investors to invest in a portfolio of different properties, locations and property types at a fraction of their cost.

Transparency

REITs will be subject to increased disclosure requirements, thereby generating more transparency and lessening perceived risk.

3) What are the advantages of investing in REITs?

Income Distribution

As mandated by law, investors can expect to receive annually 90% of distributable income as dividends.

Committed, experienced sponsors

Investors can easily purchase and dispose of REIT shares, which are readily convertible to cash.

Traded on the Philippine Stock Exchange

REITs allow investors to invest in a portfolio of different properties, locations and property types at a fraction of their cost.

4) How do REITs compare with other investments?

| Philippine REITs | Listed Property Stocks | Real Estate | Bonds | |

|---|---|---|---|---|

Affordability | Can be bought at smaller ticket sizes | Can be bought at smaller ticket sizes | Requires substantial capital commitment (cash and/or debt) | Can be bought at smaller ticket sizes |

Distribution Policy | Required to pay out at least 90%* of distributable income as dividends annually *To qualify for tax incentives | No required minimum dividend payout | Properties do not pay dividends; cash flow is generally based on rental payments by tenants or users | Defined interest payments to bondholders |

Asset & Earnings Profile | At least 75% of property must be in income-generating real estate | Combination of rental income, property sales, and property development | Primarily rental income | More diverse; stable sources of earnings may reduce credit risk of the borrower |

Leverage | Up to 35% of the fair market value of the total assets held as defined by the REIT Law; up to 70% if with a publicly disclosed investment grade credit rating by a duly accredited or internationally recognized rating agency | May be higher due to large capital expenditure | As much as 90% may be financed by loans | Maximum gearing is defined in the list of bond covenants |

5) How do REITs unlock value for sponsors and investors?

A REIT has the potential to unlock the value of a Sponsor’s property portfolio and simultaneously raise cash for the Sponsor’s growth prospects, while providing investors with a new investment instrument supported by expected dividend yields and dividend growth.

REITs provide investors with

• A new investment class linked to dividend yield and growth

REITs allow property companies to

• tap into new sources of capital

• focus on core competency of building and developing properties, and

• unlock value of their properties

6) What are the factors that may enable REIT investments to function as a hedge against inflation?

REITs may be an inflation-hedged investment because of the following factors:

Built-in rental escalation clauses

Length of lease terms

Rental rates and property market values

7) Are REITs considered as admissible assets in the Philippines?

The Insurance Commission (IC) issued a circular making REITs an admissible asset with comparative risk charges.

8) For a REIT to create long-term value and sustain its yields, growth is critical. Below we list some drivers to the growth of a REIT.

Tenor and Escalation of Contracts

The primary driver of REIT growth is its ability to escalate rental income at market or above-market rates. Good REITs typically have long contracts with high-quality tenants.

M&A Opportunities

Additional properties that are value-accretive boost the growth prospects of a REIT. These can either be in the form of (a) a pipeline of assets that can be injected into the REIT by a Sponsor, or (b) third party acquisitions.

Interest Rates

Lower interest rates mean lower borrowing costs for REITs .

9) How does the strength of the sponsor affect the growth prospect of a REIT?

REITs that are supported by strong, established Sponsors with a track record in the real estate business and with a ready pipeline of assets can be an advantage for a REIT’s growth prospects.

Significant shareholder in the REIT

Pipeline of assets that may be injected into the REIT

Access to client network and relationships of the Sponsor

Experienced, professional management team

Track record in commercial real estate acquisition, management and development

Deep knowledge of and expertise in the local real estate market

10) What other factors contribute to the growth prospect of a REIT?

Reputation and track record of the sponsor in property management

Occupancy rates

Location and quality of the properties

High quality tenants and diversification

Macroeconomic factors

Capital appreciation

Tenant concentration

Financial health of tenants

Real estate supply and demand

Rental escalations

Length of lease terms

11) How do REITs work?